- #TOYOTA CAR FINANCE CALCULATOR DRIVERS#

- #TOYOTA CAR FINANCE CALCULATOR DRIVER#

- #TOYOTA CAR FINANCE CALCULATOR MANUAL#

#TOYOTA CAR FINANCE CALCULATOR DRIVER#

#TOYOTA CAR FINANCE CALCULATOR DRIVERS#

Toyota has the highest market share of any car brand in Australia, partly because it offers a wide range of vehicles that could potentially interest any mainstream car owner.įor example, Toyota sells a variety of models – hybrids, SUVs, vans, utes, sedans, hatchbacks and 4WDs – that might appeal to drivers who want a basic, stylish, family, adventure or eco-friendly car. You might also like to consider checking out RateCity's car loan leaderboard, which features the top-rated new, used and green car loans offered by a wide range of lenders. Our car loan comparison tables allow you to use filters to narrow down your search to the loan products that best suit your needs, while our car loan calculator can give you a repayment estimate. If you decide to take your car loan search into your own hands and make a comprehensive comparison, RateCity's comparison tools can take the hassle out of shopping around. Appoint a finance broker to act on their behalf.Use a comparison website, such as RateCity, to research options.

To get around this, there are three other ways that buyers can typically organise a Toyota car loan: Typically, you get convenience in exchange for higher interest rates, higher fees or both. However, dealer finance tends to be relatively expensive for buyers. There are a number of options, including the Toyota Access car loan with its 'Guaranteed Future Value' agreement.

#TOYOTA CAR FINANCE CALCULATOR MANUAL#

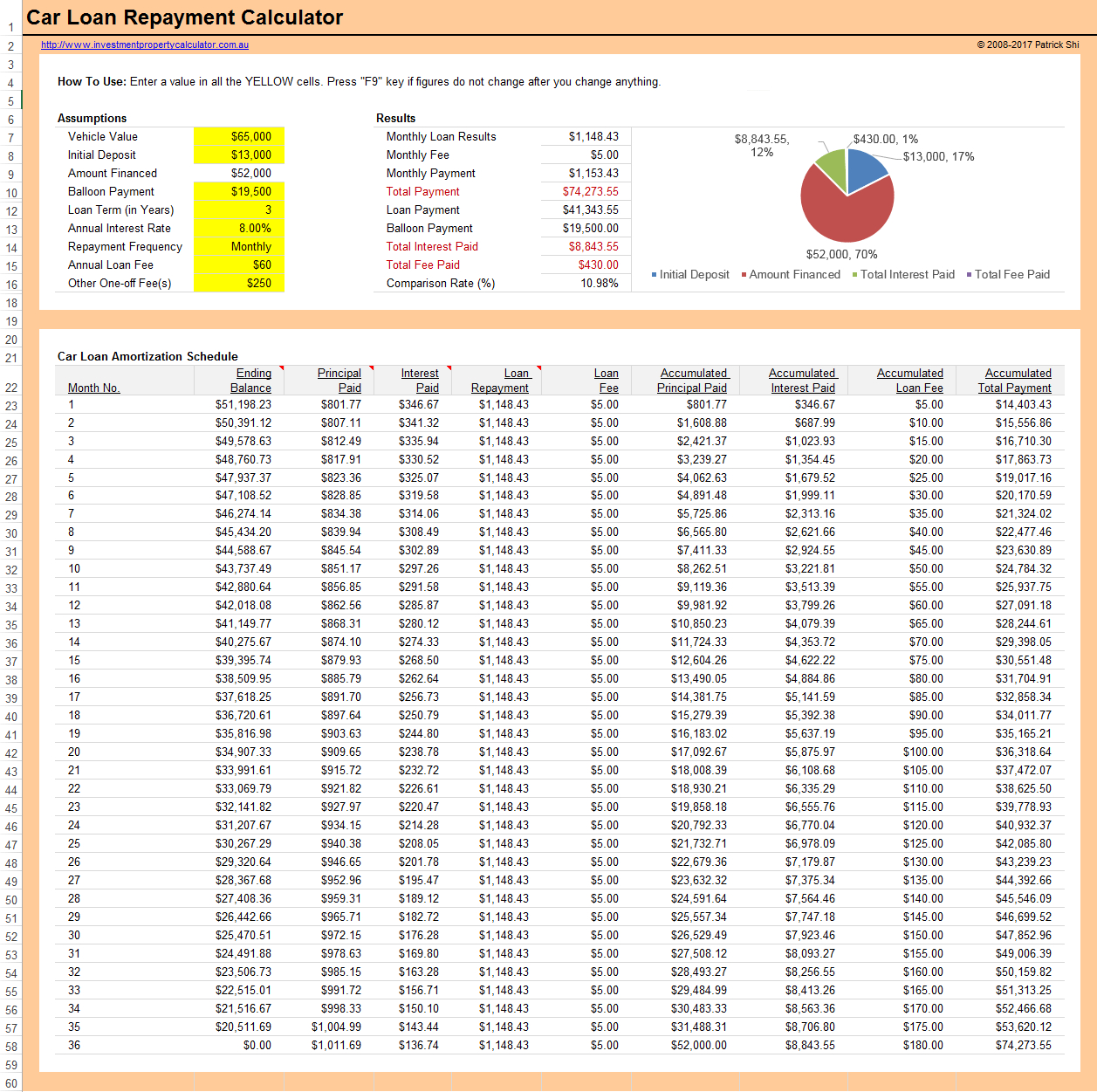

This is usually the main concern for the average car buyer to see if it fits their budget Monthly installments can be done via manual or auto deduction.Toyota, like many brands, has an in-house finance offering that helps buyers organise car loans for their new cars. With the car loan amount, loan tenure, and interest rate decided, a monthly installment amount will be obtained. Keep in mind that an early settlement for your car loan will not drastically reduce the interest that you have to pay. The choice is yours to make depending on your financial needs. Some car buyers prefer to pay a higher down payment to reduce the interest paid, while some prefer to have more cash in hand. Down payments can also be paid by trading in your current vehicle. Down payment and interest ratesĪ minimum of 10% down payment is usually required by banks for the purchase of a brand-new car and about 20% for a used car. The interest rate of the car loan will be affected by the type of car (sports car/family car), loan amount, loan tenure, and your credit history. Whether or not you will be eligible for a car loan depends on factors like the loan amount, loan tenure, your monthly net income, credit score, and other factors. Car Loan EligibilityĬar loan or financial service providers include banks and some car companies themselves. Loans enable you to hold on to your cash in hand by charging you an interest over a certain period of time. In Malaysia, car loan tenures can take up to 5, 7, or even 9 years. The bank’s valuation of the car is important since it serves as a collateral in case of loan default. Used cars can be purchased on a loan too, provided they’re not valued too low. Purchasing a brand-new car is usually done with car loans or financing services.

0 kommentar(er)

0 kommentar(er)